WHAT WE DO

Delivering the Materials that Drive Modern Life

Copper is essential to the technologies that shape the modern world from renewable energy systems to transportation and communication networks. Candente Copper ensures that this vital resource is developed responsibly and efficiently.

Project Development

Advancing high-quality copper projects with strategic global significance.

Resource Innovation

Applying advanced exploration techniques and modern engineering solutions.

Sustainability Integration

Embedding environmental responsibility at every stage of development.

Strategic Partnerships

Collaborating with investors and stakeholders who share our vision for sustainable growth.

Operational Efficiency

Leveraging data, planning and technical expertise for long-term performance.

ABOUT CANDENTE COPPER

A Vision for Responsible Development

Candente Copper is a modern mining and exploration company dedicated to unlocking the potential of strategic copper resources. Our commitment extends beyond discovery, we focus on efficiency, environmental stewardship and long-term value creation.

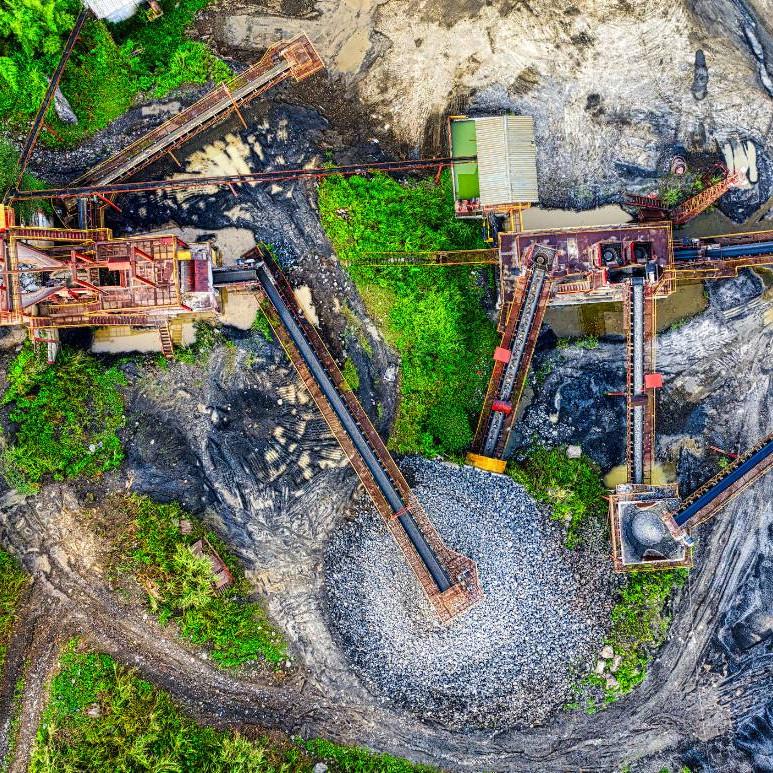

Our flagship Cañariaco Project in Northern Peru exemplifies our approach: a world-class copper deposit developed with precision, responsibility, and respect for the land. Guided by global standards and sustainable practices, we aim to set a benchmark for transparent and efficient resource development.

HOW WE WORK

Performance with Purpose

Every project at Candente Copper is driven by a disciplined, performance-based approach. We believe success is achieved not only through discovery but through responsibility, precision and execution.

- Plan with Integrity: Every initiative begins with a long-term, transparent strategy.

- Develop with Precision: We apply modern technologies and methodologies for efficient extraction and management.

- Operate with Responsibility: Environmental and social sustainability guide our decisions at every step.

- Deliver with Impact: Our results are measured in both economic value and global contribution.

“Every resource we develop supports the world’s transition toward cleaner, smarter energy.”

Get in Touch

For partnership opportunities, media inquiries or investor relations, reach out to our team.

OUR COMMITMENT

Sustainable Growth for a Sustainable Future

Candente Copper aligns its operations with the global push for sustainability and clean energy. As demand for copper increases across renewable sectors, we recognize our role in providing the materials that fuel progress responsibly.

Our commitment extends to transparency, innovation and collaboration ensuring that every project we advance contributes meaningfully to the world’s energy and infrastructure transformation.

The Future Is Forged in Copper

Let’s Build the Future Together

Whether you’re an investor, collaborator or innovator connect with us to shape sustainable development.

Candente Copper focuses on the exploration and development of high-quality copper projects with global relevance. Our expertise lies in advancing strategic resource assets that support clean energy technologies, industrial innovation, and sustainable infrastructure worldwide.

The Cañariaco Project, located in Northern Peru, is one of the largest undeveloped copper deposits in the Americas. It represents Candente Copper’s commitment to responsible development, efficiency, and long-term value creation within a globally significant resource corridor.

Copper is a critical material used in energy systems, transportation, communications, and technology infrastructure. As the world transitions toward renewable energy and electric mobility, demand for copper continues to rise — making responsible production more important than ever.

Sustainability is embedded in every phase of our operations. From exploration planning to project development, we prioritize environmental protection, energy efficiency, and transparent reporting. Our goal is to create long-term value with minimal ecological impact.

Our strength lies in disciplined execution, modern engineering, and responsible governance. Candente Copper combines deep technical knowledge with a future-oriented business model — ensuring that our projects meet both economic and environmental benchmarks.

Yes. We actively seek strategic partnerships with investors, industry experts, and organizations that share our vision for sustainable resource development. Collaboration drives innovation, operational efficiency, and global impact.

You can follow official updates, announcements, and project milestones on our website. For investor relations or media inquiries, we invite you to connect with our team through the contact form provided below.

Building the Materials of Tomorrow

Join us in shaping the foundation of a more sustainable, connected world.

© 2025 Candente Copper. All rights reserved.

© 2025 Candente Copper. All rights reserved.