The Electrification Paradox: Demand Outpacing Discovery

The global energy landscape is currently undergoing a transformation of historic proportions. At the heart of this shift lies a singular, reddish-brown metal: copper. Often referred to as "Doctor Copper" for its ability to diagnose the health of the global economy, the metal is now facing a structural crisis. The widening gap between projected demand and available supply is no longer a fringe concern of industry insiders; it has become a central theme for global policy and investment strategy.

Meeting this demand requires a commitment to responsible resource development to ensure that new projects can navigate complex regulatory environments and secure social licenses to operate.

The paradox of the modern era is that our path to a carbon-neutral future is paved with minerals that require intensive extraction. As the world pivots away from fossil fuels, the demand for copper—the primary conductor of electricity—is skyrocketing. From the intricate wiring of electric vehicles (EVs) to the massive infrastructure required for wind and solar farms, copper is the non-negotiable ingredient of the green transition. However, as demand trajectories point toward the stratosphere, the supply side of the equation remains grounded by decades of underinvestment and geological reality.

The Role of the Green Transition

To understand the scale of the deficit, one must look at the intensity of copper usage in emerging technologies. A conventional internal combustion engine vehicle contains roughly 20 to 50 pounds of copper. In contrast, a battery-electric vehicle requires between 130 and 180 pounds. On a larger scale, renewable energy systems require up to twelve times more copper than traditional power generation methods. This shift represents a fundamental change in the global consumption pattern of base metals, moving from cyclical industrial use to a secular, structural necessity.

Structural Barriers to Supply

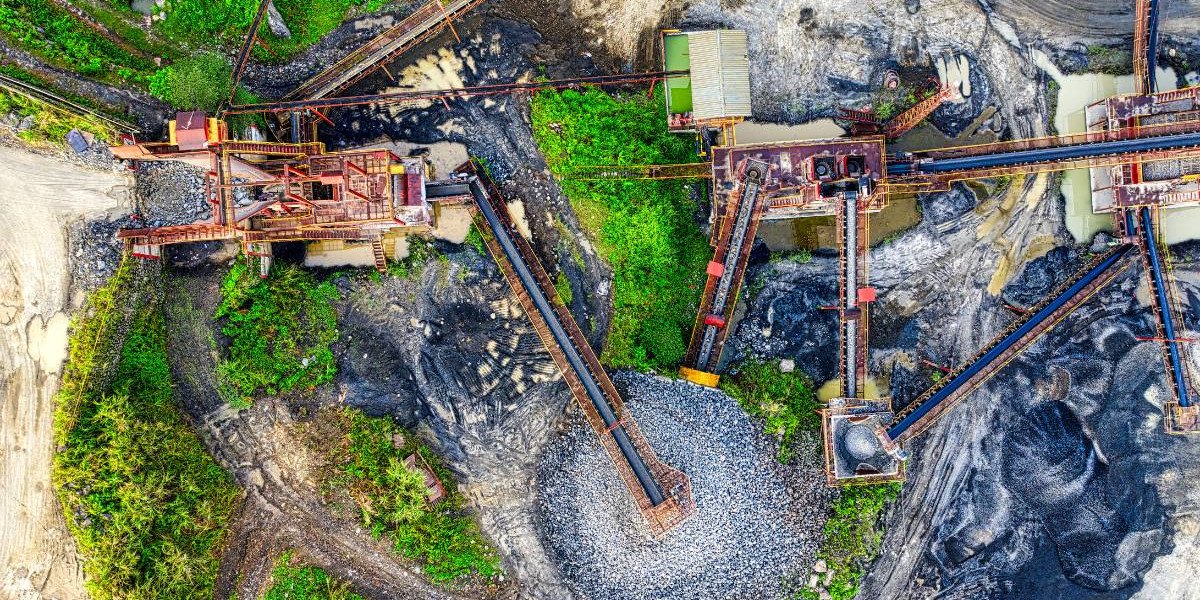

If the demand for copper is so transparently high, the logical question is why supply has failed to keep pace. The answer lies in a complex web of geological, economic, and geopolitical factors that cannot be resolved overnight. Mining is not a "just-in-time" industry; it is a marathon that requires decades of foresight.

Several key factors are currently constricting the global copper pipeline:

- Declining Ore Grades: The world’s "easy" copper has already been mined. In major producing regions like Chile, ore grades have declined by approximately 25% over the last decade, meaning miners must process significantly more rock to produce the same amount of finished metal.

- Lengthy Permitting and Development Timelines: It now takes an average of 15 to 20 years for a copper discovery to reach first production. Stringent environmental regulations and complex bureaucratic processes, while necessary for responsible development, have extended lead times significantly.

- Geopolitical Volatility: A significant portion of the world’s copper reserves is located in jurisdictions facing political uncertainty or social unrest. Changes in mining codes, royalty structures, and local opposition can stall or cancel major projects.

- Capital Underinvestment: Following the commodity price crash of the mid-2010s, many mining majors prioritized balance sheet repair and shareholder dividends over exploration and development. This has left a void in the project pipeline that is only now being addressed.

The Challenge of New Discoveries

Major copper discoveries have become increasingly rare. Despite increased exploration budgets over the last few years, the number of "tier-one" assets—those capable of producing over 200,000 tonnes per year for decades—is dwindling. Most current growth is coming from brownfield expansions of existing mines rather than the greenfield projects required to meet future demand. This lack of new, large-scale projects creates a ceiling on how quickly the industry can respond to price signals.

The Investment Landscape: Navigating the Shortfall

From an investment perspective, the copper supply deficit represents one of the most compelling narratives in the natural resources sector. Analysts at major financial institutions, including Goldman Sachs and S&P Global, have repeatedly warned of a "copper crunch" by the late 2020s. Some estimates suggest a shortfall of nearly 10 million tonnes by 2035 if new projects are not fast-tracked.

This looming deficit is expected to provide a strong floor for copper prices, but it also changes the criteria for evaluating mining investments. Investors are increasingly looking beyond mere tonnage and focusing on "responsible supply." In an era of heightened ESG (Environmental, Social, and Governance) awareness, the copper that the world needs must be produced with minimal environmental impact and maximum benefit to local communities. Projects that can demonstrate a clear path to sustainable production are likely to command a premium in a supply-constrained market.

A Future Defined by Scarcity

The growing supply deficit in the global copper market is not a temporary imbalance but a structural reality of the 21st-century economy. The transition to a sustainable energy future is effectively a transition to a mineral-intensive future. As the world attempts to electrify everything from transportation to home heating, the pressure on copper miners to perform will only intensify.

For the market to reach equilibrium, a massive influx of capital into exploration and development is required, alongside a streamlined approach to permitting that does not compromise on environmental standards. Until then, the copper deficit remains a significant bottleneck for global climate goals and a defining theme for the next decade of resource investment. The metal of the past is undeniably the metal of the future, but only if we can find enough of it to power the world we are trying to build.