The Silent Pulse of Progress: Contemplating the Copper Gap

In the quiet hum of an electric engine and the invisible flow of data through a skyscraper’s veins, there lies a singular, unyielding constant: copper. For centuries, this red metal has been the silent partner of human ingenuity. Yet, as we stand at the precipice of a global energy transition, we are forced to confront a sobering reality. The world is facing a growing supply deficit in the copper market, a gap that is not merely a statistical anomaly but a reflection of our collective ambition outstripping our current earthly reach.

To reflect on the copper market today is to recognize a profound irony. At the very moment humanity has committed to a cleaner, more electrified existence, the primary material required to build that future is becoming increasingly difficult to secure. This deficit invites us to look deeper into the mechanics of our global economy and the responsibilities we hold as stewards of natural resources.

The Paradox of Modern Demand

The narrative of the copper deficit is often framed in the cold language of supply and demand curves. However, the true story is one of human transformation. We are moving away from a carbon-heavy past toward a future defined by decarbonization and electrification. This transition is not a luxury; it is a necessity. But this necessity carries a heavy price in raw materials.

The Decarbonization Dilemma

Consider the electric vehicle (EV). A single EV requires nearly four times as much copper as a traditional internal combustion engine vehicle. When we multiply this by the millions of cars intended to hit the roads in the coming decade, the scale of the challenge becomes clear. Furthermore, the wind turbines and solar farms that will power these vehicles are themselves copper-intensive. We are, in essence, trying to rebuild the world’s energy infrastructure from the ground up, using a metal that is becoming harder to find and more complex to extract.

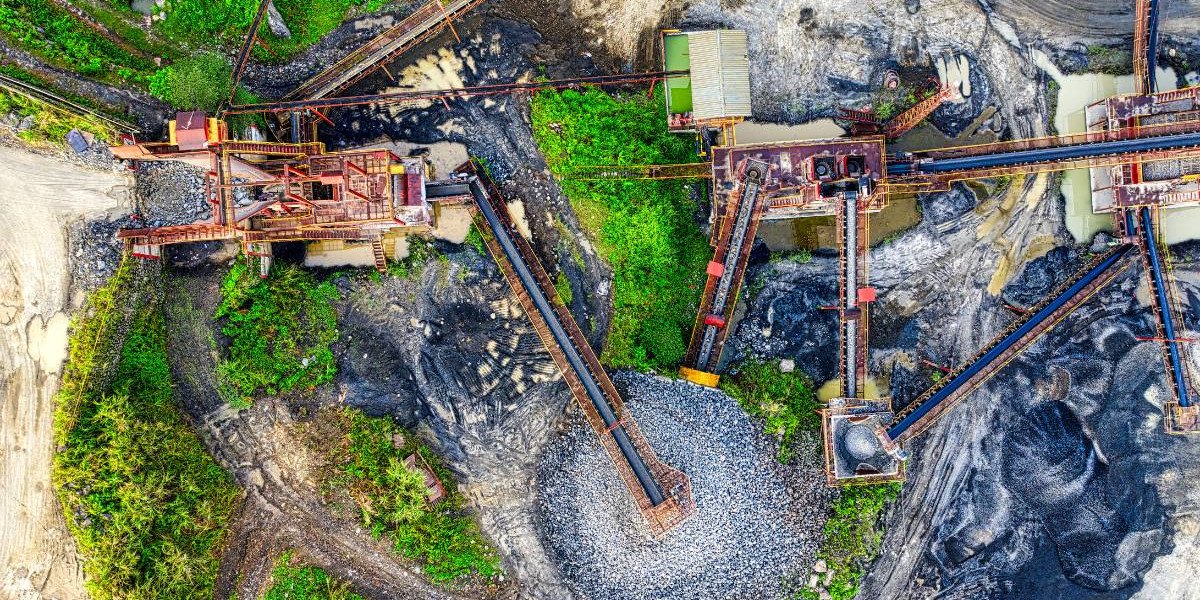

The Fragility of Supply

While demand soars, the supply side of the equation remains tethered to the slow, deliberate pace of geological and industrial reality. Many of the world’s largest copper mines are aging, their ore grades naturally declining as the easiest-to-reach deposits are exhausted. To replace this lost production, new mines must be discovered and developed. Yet, the path from a discovery to a producing mine is now longer than ever, often spanning fifteen to twenty years due to regulatory hurdles, environmental considerations, and the sheer technical difficulty of modern mining.

Why the Deficit is Deepening

The growing gap in the copper market is not the result of a single factor, but rather a convergence of several global shifts. To understand the depth of this deficit, we must look at the structural barriers that prevent supply from keeping pace with our aspirations:

- Declining Ore Grades: The quality of copper ore being mined globally is steadily dropping, meaning more rock must be processed to produce the same amount of metal.

- Lack of Major Discoveries: Despite increased exploration budgets, the industry has seen a dearth of “tier-one” copper discoveries over the last two decades.

- Geopolitical Complexity: Many of the world’s remaining copper deposits are located in jurisdictions where political instability or changing fiscal regimes can stall development.

- Environmental and Social Governance (ESG): The necessary and vital shift toward responsible mining means that projects must meet higher standards of sustainability, which requires more time, investment, and community engagement.

Reflecting on Value and Responsibility

As we navigate this period of scarcity, the concept of “value” in the copper market is being redefined. For the thoughtful investor and the responsible developer, value is no longer just about the spot price of a commodity. It is about the long-term viability of resources and the integrity with which they are brought to market.

The copper deficit teaches us that we can no longer take the earth’s bounty for granted. It requires us to adopt a mindset of stewardship rather than mere consumption. This means supporting mining practices that prioritize water conservation, minimize carbon footprints, and create lasting benefits for local communities. In the face of a supply gap, the projects that will ultimately succeed are those that align their operational goals with the broader values of a sustainable society.

The Long View: A Call for Foresight

Looking ahead, the copper market deficit serves as a reminder of the intricate interconnectedness of our world. A delay in a mining project in South America can ripple through the supply chains of European automakers and affect the renewable energy goals of North American cities. We are all participants in this delicate balance.

For those of us involved in the world of resource development and investment education, this deficit is a call to action. It is an invitation to look beyond the immediate volatility of the markets and focus on the fundamental role that copper plays in the human story. The gap between supply and demand is a space of opportunity—an opportunity to innovate, to refine our practices, and to build the foundations of a future that is as resilient as the metal itself.

Conclusion: The Red Metal’s Quiet Revolution

The growing copper supply deficit is more than a market trend; it is a testament to the scale of the global transition currently underway. As we reflect on the challenges of scarcity, we find a renewed appreciation for the essential role of responsible mining. By understanding the complexities of the copper market, we can better appreciate the effort required to power our world and the profound importance of developing resources with a vision for the long term. The red metal remains at the heart of our progress, reminding us that a sustainable future is not just dreamed—it is built, one ton of copper at a time.